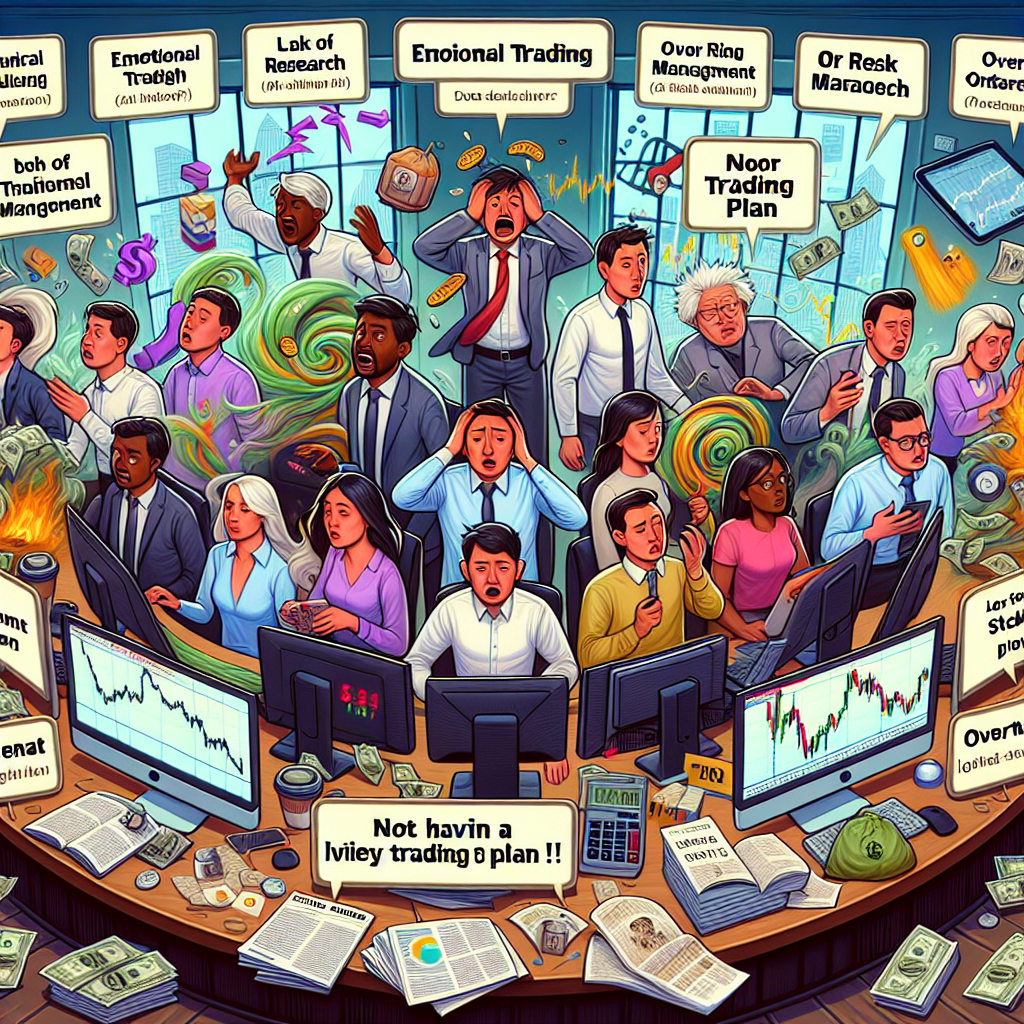

The Top 5 Mistakes New Day Traders Make and How to Avoid Them for Long-Term Success

Day trading can be an exhilarating journey filled with potential profits, but it can also be a minefield of pitfalls, especially for newcomers. Many aspiring traders jump into the fast-paced world of stocks, forex, and futures without fully understanding the common traps that can derail their success. By identifying these mistakes and learning how to avoid them, you can set yourself up for a rewarding trading career. Let’s dive into the top five mistakes new day traders often make and explore tactical strategies to steer clear of them.

1. Overtrading

One of the most common missteps is overtrading, where traders execute too many trades in a short period. This often leads to burnout and significant losses. Solution: Establish a clear trading plan with defined entry and exit points. Stick to this plan and limit yourself to a certain number of trades per day to maintain focus and discipline.

2. Ignoring Risk Management

New traders often neglect the importance of risk management, which can lead to devastating losses. Trading without a safety net is like walking a tightrope without a harness. Solution: Adopt strict risk management rules. Aim to risk no more than 1-2% of your trading capital on any single trade. This approach allows you to withstand losses and keep your trading account healthy over time.

3. Letting Emotions Take Control

Emotions can be a trader's worst enemy. Fear and greed often drive poor decision-making, resulting in impulsive trades. Solution: Develop emotional discipline by implementing a trading journal. Document your trades, feelings, and decisions. This practice helps you reflect on your emotional responses and develop a more rational approach to trading.

4. Neglecting to Educate Yourself

Many new traders enter the market with little to no knowledge of technical analysis or market trends. This lack of education can lead to poor trading decisions. Solution: Commit to continuous learning. Utilize resources like webinars, books, and courses to enhance your trading skills. Check out DayTraderDiana.com for valuable tips and strategies tailored for both beginner and advanced traders.

5. Chasing Losses

When faced with a losing trade, it’s easy to succumb to the temptation of trying to recover losses by making rash decisions. This often results in a downward spiral of losses. Solution: Embrace the mindset of acceptance. Losses are part of the trading journey. Instead of chasing losses, take a step back, reassess your strategy, and consider a break to regain perspective.

Conclusion

Avoiding these common mistakes is essential for new day traders who aspire to achieve long-term success. By focusing on disciplined trading, effective risk management, emotional control, continuous education, and accepting losses as a part of the process, you can create a solid foundation for your trading career. Remember, the path to becoming a successful trader is not a sprint but a marathon. Equip yourself with the right tools and knowledge, and you’ll be well on your way to thriving in the dynamic world of day trading. Stay motivated and tactical, and your efforts will pay off!